10 Easy Facts About Medicare Graham Explained

10 Easy Facts About Medicare Graham Explained

Blog Article

The Facts About Medicare Graham Revealed

Table of ContentsThe Main Principles Of Medicare Graham The Medicare Graham PDFsNot known Facts About Medicare GrahamLittle Known Questions About Medicare Graham.The Medicare Graham StatementsThe smart Trick of Medicare Graham That Nobody is DiscussingMedicare Graham - Questions

The phone number for the Social Safety and security workplace in your location can be located in the Important Phone Figures area of this site.There are some Medicare Health Strategies that cover prescription medications. You can also check right into obtaining a Medigap or supplementary insurance coverage policy for prescription medicine protection.

The 25-Second Trick For Medicare Graham

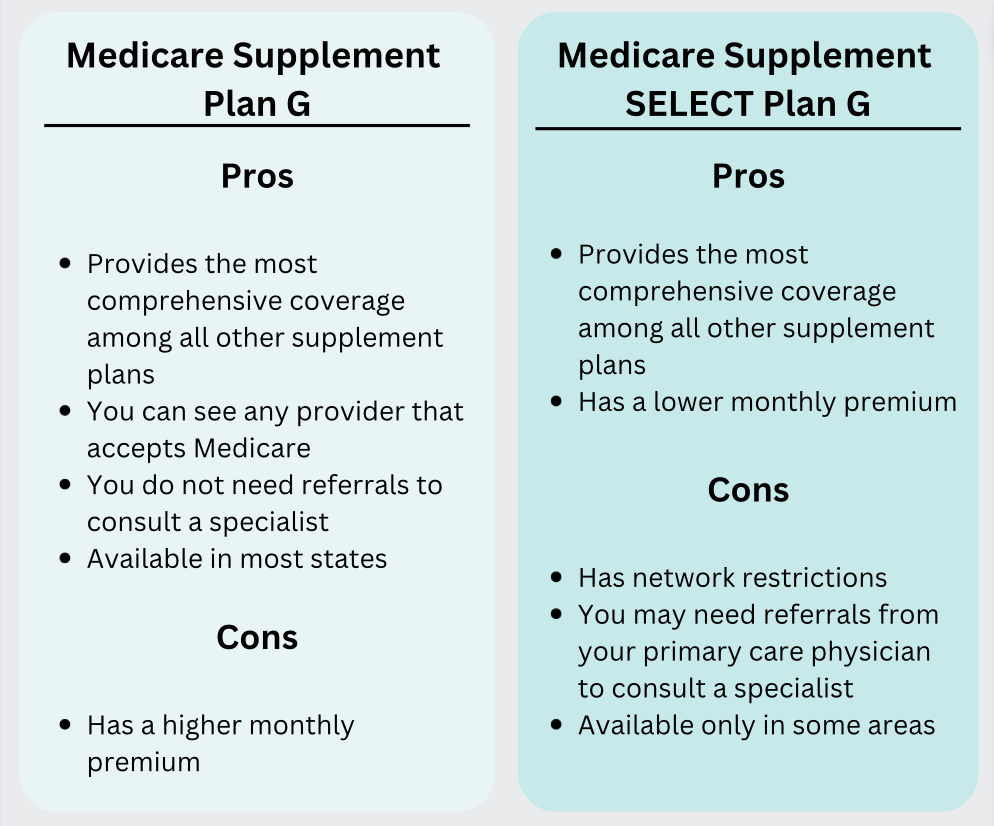

Medigap strategies are private health and wellness insurance coverage plans that cover some of the costs the Original Medicare Plan does not cover. Some Medigap policies will certainly cover solutions not covered by Medicare such as prescription medications.

Your State Insurance policy Department can address inquiries about the Medigap policies offered in your location. Inspect the Important Phone Numbers section of this internet site for the phone number of your State Insurance Coverage Department. If you have functioned at the very least 10 years in Medicare covered work you will certainly qualify for exceptional cost-free Medicare Part A (Health Center Insurance Coverage).

How Medicare Graham can Save You Time, Stress, and Money.

Examine the Important Phone Figures section of this internet site for the telephone number of the Social Safety And Security Office in your location. Medicare Component B assists pay for medical professionals' services, outpatient health center care, blood, medical devices and some home health and wellness services. It additionally spends for other medical services such as lab tests and physical and job-related treatment.

The Ultimate Guide To Medicare Graham

Medicare does not cover insulin and syringes. An insurance deductible is the amount you have to pay each year before Medicare starts paying its part of your medical expense. Medicare Near Me.

Your insurance deductible is secured of your claims when Medicare receives them. Medicare will certainly not begin paying on your cases until you have fulfilled your yearly deductible. If you have any kind of questions on the condition of your deductible please contact your Medicare provider. Medicare managed care strategies are an additional way for you to obtain Medicare benefits.

In basic, the four Medicare components cover various solutions, so it's necessary that you recognize the choices so you can pick your Medicare protection carefully.

Whatever your scenario, you become qualified for Medicare when you reach 65. If you already obtain Social Safety, you'll be registered in Medicare automatically the month you turn 65. For the majority of people, there is no regular monthly cost for Component A if you or your partner paid Medicare tax obligations for at the very least 10 years.

At that point, you pay $0 for top article the first 60 days of coverage. Co-payments request keeps past 60 days and you spend for the entirety of your hospital keep after 150 days. Medicare Part A covers hospice care at an inpatient facility, it must be set up through a Medicare-approved hospice service provider.

The Definitive Guide to Medicare Graham

Kathryn B. Hauer, an economic expert at Wilson David Investment Advisors and the writer of Financial Suggestions for Blue Collar America, advises that ravaging illnesses such as cancer can ravage your funds in retirement and advises Medicare recipients to take into consideration supplementary insurance coverage. She notes that Medicare individuals without Medigap insurance coverage spend 25% to 64% of their revenue on clinical expenditures.

Some Known Factual Statements About Medicare Graham

(https://www.bitchute.com/channel/l0DEMmMSX9PK)Medicare will certainly cover acute-care healthcare facility solutions for patients that are moved from an intensive care or vital treatment system. Depending on your strategy, you might need to pay an annual deductible before qualified medicine costs are covered, and some Component D plans have a co-pay.

Report this page